Paul Clarke of Clarkes Estates

The UK mortgage market has kicked off the year with an unexpected surge in activity, as several major lenders begin aggressively reducing fixed-rate products. For buyers, sellers and homeowners reviewing their current mortgage, this is the most positive shift seen in more than three years.

A wave of rate cuts across major lenders

A number of high-street banks and building societies have launched new, lower-priced fixed deals in recent days. Many are focusing on products for buyers with stronger deposits, although remortgage customers are also starting to benefit.

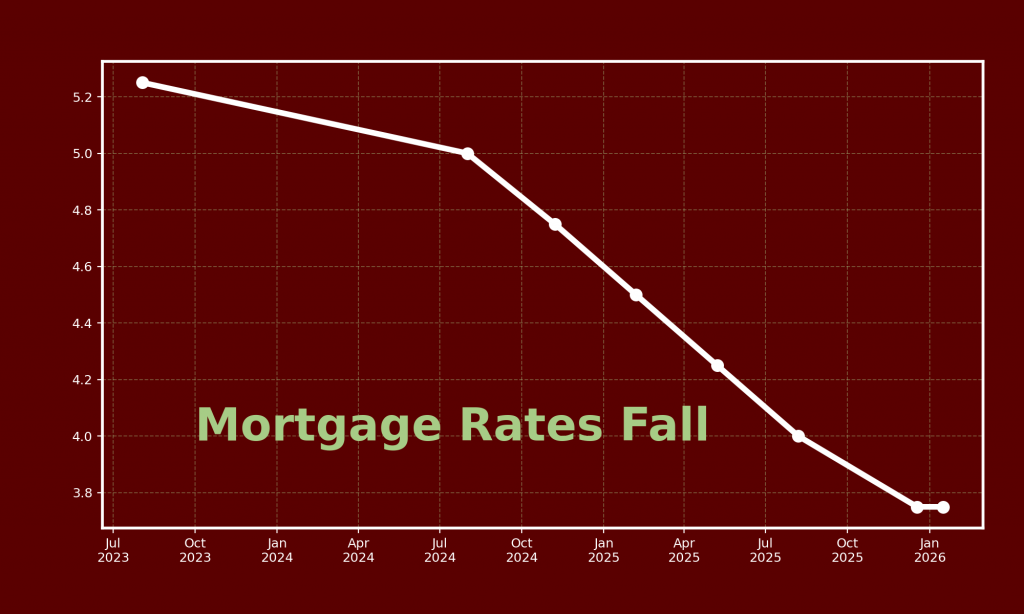

Some lenders are now advertising two-year fixed rates in the mid-3% range for borrowers with 40% equity. Five-year deals have also dipped below 4%, marking the lowest fixed-rate pricing since the period before the 2022 mini-budget turbulence.

Although fees and exact product structures vary between lenders, the overall trend is clear: competition is increasing, and lenders are keen to capture market share early in the year.

Why rates are falling

Two key factors are driving the renewed price competition:

- Improved economic forecasts – Inflation has continued to ease, giving lenders more confidence in longer-term affordability trends.

- Expectations of further base rate cuts – Analysts widely expect the Bank of England to reduce the base rate again soon. With multiple cuts already behind us since 2024, lenders appear to be pricing in additional downward movement.

This combination has created what many brokers are calling the first genuine “price war” since before the pandemic years.

Good news for movers and homeowners coming off fixed deals

An estimated 1.8 million homeowners are due to roll off their fixed-rate mortgages this year. Many of those deals were taken out in a much higher interest-rate environment, so even a small drop in fixed rates can translate into significant monthly savings.

Mortgage brokers are already reporting increased enquiries, particularly from:

- Homeowners within six months of their fixed deal ending

- First-time buyers who postponed moves last year

- Sellers keen to relaunch with improved affordability in the buyer market

Most lenders allow borrowers to secure a new rate up to six months in advance. Some even offer early switching options without early repayment charges, depending on product type and timing.

Should borrowers wait for even lower rates?

Specialists caution against trying to “time the bottom” of the market. While pricing could fall further, the consensus is that future reductions are likely to be moderate rather than dramatic.

Many brokers are suggesting a pragmatic approach:

- Secure a rate now to protect against increases

- Switch to a lower rate later if your lender allows changes before completion

- Avoid rolling onto a lender’s standard variable rate (SVR), which is typically much higher

For buyers in particular, improved fixed rates combined with growing stock levels could make early 2026 an advantageous moment to move.

What this means for the local property market

At Clarkes Estates, we expect lower mortgage pricing to:

- Boost buyer affordability

- Increase viewing numbers across West Sussex

- Support higher confidence for sellers considering relaunching or adjusting pricing

- Encourage more first-time buyers back into the market

Although the market still faces broader economic pressures, this shift in lending behaviour is one of the strongest indicators of stabilisation we have seen in several years.