The Chancellor of the Exchequer Kwasi Kwarteng has announced major changes to Stamp Duty in England and Northern Ireland.

The aim being to support home ownership by helping first time buyers get on the property ladder, encourage people to move home rather than stay where they are and do work to their current home. Perhaps even encouraging builders and developers to get in the game. Promoting mobility in the housing market and in turn stimulating economic growth.

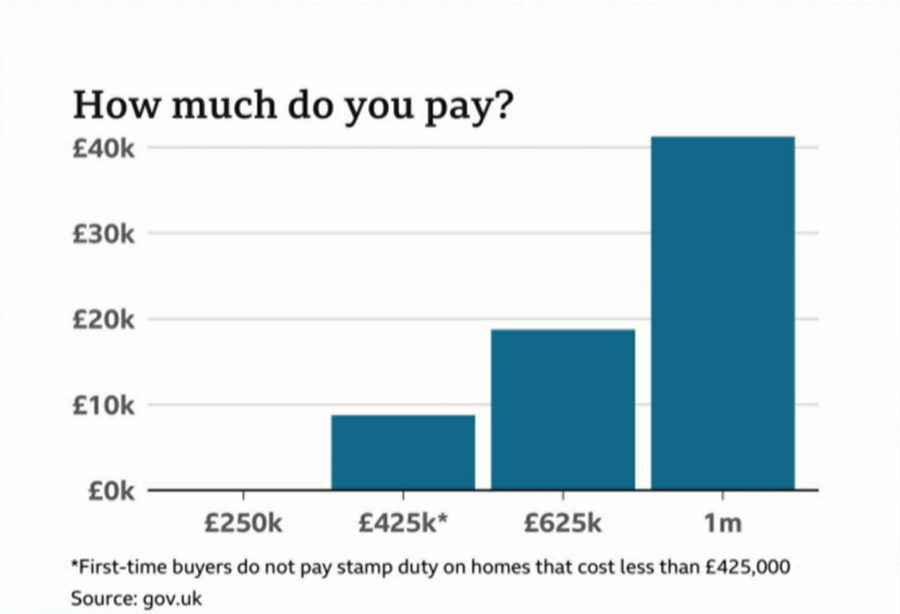

The threshold before stamp duty is payable has been raised from £125,000 to £250,000, resulting in savings up to £2,500 but still maintaining the higher rate of 3% payable on additional dwellings.

The nil-rate threshold for ‘First Time Buyers’ Relief has been increased from £300,000 to £425,000 and the maximum amount that an individual can pay while remaining eligible for First Time Buyers’ Relief is increased to £625,000. Resulting in huge savings for first time buyers in England. These measures do not apply to Scotland or Wales who operate their own land transactions taxes.

This simple graph shows how much ‘you’ the home mover would pay under the new stamp duty rules.

The new stamp duty rules will apply to transactions with effective dates on and after 23 September 2022.

If you have any questions, we are happy to assist you. Pop into our office at 2 Station Road, Bognor Regis or call us on 01243 861344